Get your business registered under GST with Miraal Tax Consulting

Priced at Only Rs 1,999/-, this plan will help your business adapt to GST implementation and cater to all compliance and registration requirements along with expert advisory.

ELIGIBILITY*

The eligibility for GST (Goods and Services Tax) registration varies by country, as each country has its own set of rules and regulations. I’ll provide a general overview based on the GST system in India, as it’s one of the prominent countries that has implemented GST.

In India, businesses engaging in the supply of goods or services with an annual aggregate turnover exceeding the prescribed threshold limit are required to register for GST. As of my last knowledge update in January 2022, the threshold limits were as follows:

- For Goods: Aggregate turnover exceeding INR 40 lakhs (INR 10 lakhs for special category states) in a financial year.

- For Services: Aggregate turnover exceeding INR 20 lakhs (INR 10 lakhs for special category states) in a financial year.

It’s important to note that certain categories of businesses are required to register for GST irrespective of their turnover. These include:

- Businesses involved in interstate supply of goods or services.

- Casual taxable persons or non-resident taxable persons.

- Those required to deduct tax at source (TDS) or collect tax at source (TCS).

Even if a business falls below the threshold limits, it may choose to voluntarily register for GST.

Businesses that are eligible for GST registration need to apply for registration within 30 days from the date they become eligible. The registration process involves submitting an online application through the GST portal.

Since GST regulations are subject to change, I recommend checking the latest updates and threshold limits from the official GST website or consulting with a tax professional in your jurisdiction to ensure accurate and up-to-date information.

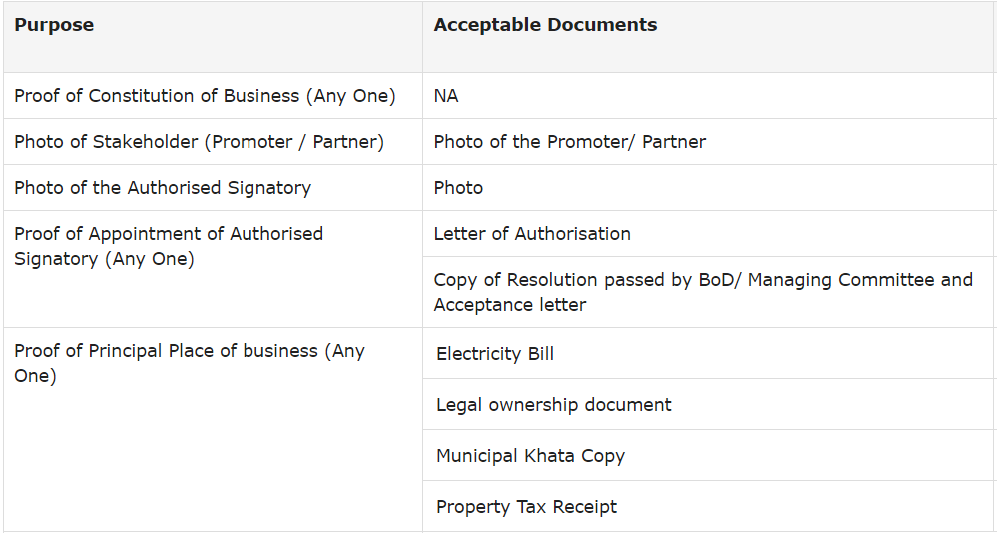

Documents Required

- Pan of the Applicant

- Aadhaar Card of the Applicant

- Address proof of the place of business

- No objection certificate from the owner of the property of the property

- Bank Account statement/Cancelled Cheque